will county illinois property tax due dates 2021

The median property tax in Will County Illinois is 4921 per year for a home worth the median value of 240500. Search Valuable Data On A Property.

Thank you for your patience.

. 1st installment due date. Tax Year 2021 First Installment Due Date. ILLINOIS PROPERTY TAX APPEAL BOARD PTABDH10-22 APPELLANT.

Yearly median tax in Will County. On November 10 2022 the GovTech online payment website will no longer accept payments for Will County. Surya Dutta DOCKET NO.

If you have a mortgage your lender will likely pay your property taxes for you and escrow the. 15 penalty interest added per. 205 of home value.

In Will County property taxes are due on June 1st and September 1st of each year. Contact your county treasurer for payment due dates. Ad Get In-Depth Property Tax Data In Minutes.

No scheduled or one-time payments will be accepted until the new site opens on. Property tax bills mailed. Tax amount varies by county.

Illinois Property Tax Appeal Board issued this date in the above. Stratton Building Room 402 401 South Spring Street Springfield IL 62706-4001 APPELLANT JC. Friday October 1 2021.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Tax Year 2020 First Installment Due. The phone number should be listed in your local phone book under Government County Assessors Office or by searching online.

Last Day to Pay 2021 Levy Taxes Online. Please call if you have any questions. Reduce property taxes 4 residential retail businesses - profitable side business hustle.

Tax Year 2020 Second Installment Due Date. Last day to submit changes for ACH withdrawals for the 1st installment. 3 as the due dates for 2021.

Start Your Homeowner Search Today. The due dates are. This early change will help his office send out.

June 27th 2022 for the 1st installment and September 6th 2022 for your 2nd installment. Such As Deeds Liens Property Tax More. The last day to pay real estate taxes online is November 10th 2022.

Penney Company Inc by attorney. State of Illinois Property Tax Appeal Board William G. Tuesday March 1 2022.

173 of home value. Ad Reduce property taxes for yourself or residential commercial businesses for commissions. Will County Treasurer Tim Brophy said the board should establish June 3 Aug.

County Treasurer Williamson County Illinois

Karen A Stukel Recorder Of Deeds Will County Il

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

North Central Illinois Economic Development Corporation Property Taxes

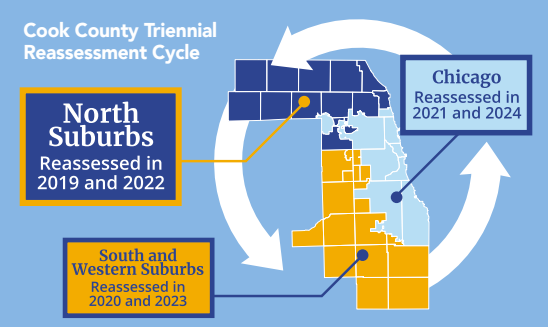

The Cook County Property Tax System Cook County Assessor S Office

Will County Delays Due Dates For 2021 Property Taxes Shaw Local

Will County Il Elections Will County Il Elections

Senior Freeze Exemption Cook County Assessor S Office

Will County Il Property Tax Getjerry Com

Tim Brophy Will County Treasurer

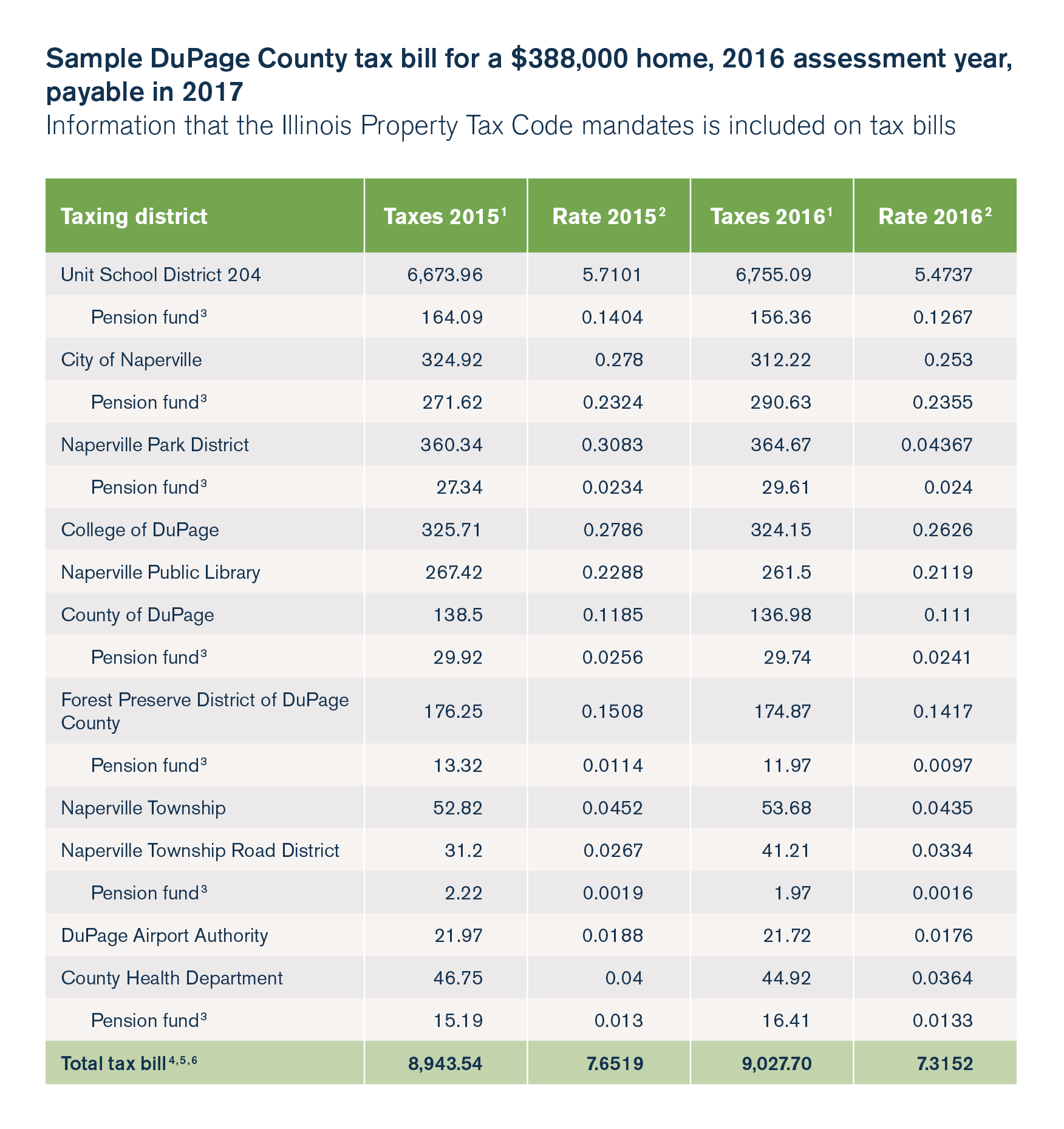

Puzzled By Property Taxes Improving Transparency And Fairness In Illinois Assessment System Illinois Policy

Online Payment System Tim Brophy

Champaign County S Removal Of Property Tax Search By Name Sought By Officials Seeking Privacy But Decision Confounds Other Assessors Cu Citizenaccess Org

Dupage Property Tax Due Dates Fausett Law Office

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Cook County Property Owner Tax Bill Payments Extended Until October 1st West Suburban Journal